Why Multi-Family? 5 Compelling Reasons to Invest in Apartments in Today’s Market

Investing in real estate has long been recognized as a solid wealth-building strategy. Even In today's market, one where uncertainty and volatility prevail - a looming recession, historically high inflation rates, continuausly-rising interest rates - multi-family real estate continues to present very compelling reasons for investors seeking stability and growth.

Let’s dive into five key reasons why multi-family investments are gaining popularity and why they should be on your radar.

Hedge Against Inflation

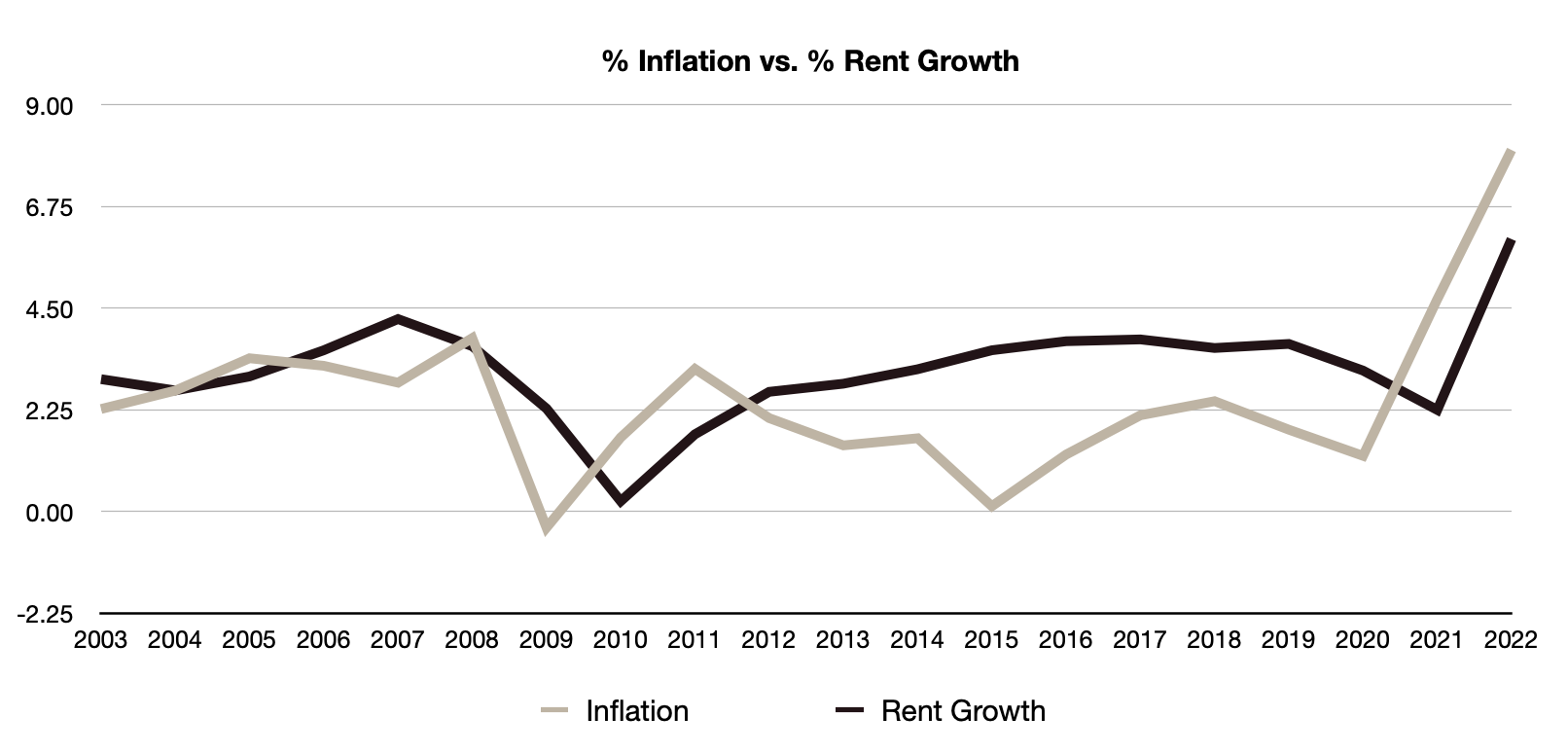

As prices rise over time, rent rates tend to increase in tandem. Rent growth increases property revenue, which expands net operating income, producing higher valuations and cash yields for investors. Unlike other assets that may struggle to keep pace with inflation, multi-family investments have the potential to provide a steady income stream that adjusts to inflationary pressures, preserving the value of your dollars and therefore, your purchasing power.

Sources: U.S. Bureau of Labor Statistics, FRED, World Bank

Forced Appreciation

Along with the natural appreciation afforded by increased income, multi-family properties offer the opportunity for forced appreciation, allowing investors to actively increase the value of their investments by diligently marketing rents to market, streamlining operations, improving the property, implementing cost-effective renovations, and enhancing amenities. This hands-on approach gives investors greater control over their investment’s appreciation potential. Other than owning or running a business, there aren’t many other investment classes that provide similar opportunities for this type of control over the growth of an asset.

Portfolio Diversification

Diversification is a fundamental principle of sound investing. Each asset class has characteristics that will react differently to the different market environments that occur over time. Through exposure to different assets, investors are able to reduce asset-class risk while navigating through business cycles. By adding apartments to your investment portfolio, you can reduce the risk associated with having all your investments concentrated in a single asset class, better positioning yourself to weather today’s inflationary market by stabilizing returns through rent growth and appreciation

Tax Benefits

Although, there are changes coming to the tax advantages provided by real estate investing (e.g. bonus depreciation reduced to 80% in 2023 and eventually to 0% in 2027), the government continues to incentivize housing providers by providing tax benefits that include expense deductions (mortgage interest, property tax, operational expenses, etc.), regular depreciation deductions, pass-through deductions on qualified business income, and the opportunity to defer capital gains taxes, among others.

I am not a CPA, so please don’t consider this tax advice; do consult with your tax professional to fully understand your tax situation and the tax advantages available to you.

Fulfill a Need

Investing in multi-family properties allows you to fulfill a fundamental need in society—providing quality housing for individuals and families. With the growing population and increasing demand for rental properties, investing in apartments offers the opportunity to contribute to the community while generating income.

In a rising interest rate environment like today, home ownership is growing more and more unattainable for many buyers. These would-be buyers are being pushed into the renter pool, further increasing demand for multi-family units. Depending on which agency has conducted the research, housing shortage figures can vary by a great deal. What everyone does agree on, though, is that there is currently a massive shortage of units, with numbers in the millions.

Investing in multi-family properties presents a compelling proposition in today's market. From the potential to hedge against inflation and forced appreciation to portfolio diversification, tax benefits, and fulfilling a housing need, apartments offer an attractive investment opportunity. By leveraging the unique advantages of multi-family real estate, investors can build wealth, generate consistent cash flow, and navigate the uncertainties of the market with greater confidence. Embracing the multi-family asset class can pave the way for financial success and long-term prosperity.

There are inherent risks associated with any investment, including multi-family assets. It’s important to conduct thorough research, engage with the necessary professionals, and analyze market conditions before making any investment decisions. Please don’t hesitate to reach out if you’d like to discuss any of this or to review your investment strategy with us.