Oil & Gas: Exploring the Benefits and Uncovering the Risks

Investing in various asset classes is an essential strategy for diversifying your portfolio and pursuing financial growth. While there are multiple investment opportunities available, some which we’ll go over in future blog posts, one sector that has historically attracted investors is oil and gas. Today, we’ll explore the reasons why investing in oil and gas can be a prudent decision, and we’ll also uncover the risks associated with these investments. We’ll start by reviewing the different investment methods you have available to you.

How do you invest in oil and gas?

Oil & Gas Futures Contracts

These are legal agreements that involve trading a specified number of barrels at a preset price on a specific date in the future. This is an indirect investment method and is as simple as placing an order with your investment broker.

Oil & Gas Company Stocks / ETFs and Mutual Funds

If you purchase an oil and gas company stock, you will own a portion of the company you invest in. If you purchase shares of an ETF or mutual fund, you’re pooling your money with other investors’ in order to invest in the oil and gas sector. These are both indirect investment methods.

Mineral Rights

Ownership of mineral rights provides the owner with the right to explore and/or utilize the resources beneath the land. This is a direct investment method where your ownership will provide rights to a specific piece of land.

Equity Direct Participation Programs

This is a pooled investment where multiple investors come together to fund and/or buy shares in an oil or gas venture. This is a direct investment method that allows the investors to share in the profits generated by the company and the tax benefits afforded the business. There are nuances to this, which we’ll cover in the next section.

What are some of the benefits of investing in oil and gas?

Tax Advantages

I’ll start and spend a little more time here since I personally believe that this is the most compelling benefit to investing in oil and gas.

Investing in oil and gas can offer certain tax advantages, depending on the jurisdiction and investment structure. As mentioned above, Direct Participation Programs are direct investments that allow you to enjoy the benefits of the tax benefits afforded to the underlying business.

As we’ve previously noted in prior newsletters and blog posts, the tax code is written to incentivize U.S. citizens to invest in or provide services that the government isn’t able to do on its own. In the 1970’s, the U.S. experienced a massive gas shortage due to the OPEC cartel cutting off our oil supply. In response, the federal government created lucrative tax breaks for Americans to invest in domestic oil and gas production. Direct energy investing still offers some of the most lucrative tax advantages in the entire U.S. tax code.

When investing directly in an oil and gas venture, there are often two ways to do so - as a general partner or as a limited partner. General partners gain access to tax deductions from their active income (i.e. wages, salary) but also take on unlimited liability. Limited partners enjoy limited liability but can only take deductions from passive income.

The 3 key benefits the government created in the tax code:

Intangible Drilling Costs - these are roughly 75-80% of well costs and include costs that cannot be reused. Examples include labor and rig rental. 100% of these expenses can be deducted in the year they are incurred.

Tangible Drilling Costs - these are roughly 20-25% of well costs and include costs that can be recovered or resold when drilling ends. Examples include storage tanks, wellheads, and surface equipment. Currently, 80% of these expenses can be deducted in year one. Previously, 100% was able to be deducted, but starting January 1st of this year, the amendment to Section 168(k) of the Internal Revenue Code began phasing out this benefit at a rate of 20% each year through the end of 2026.

Depletion Allowance - this benefit allows you to deduct 15% of the annual income from your oil and gas well once production comes online; this benefit exists as long as the oil well is producing.

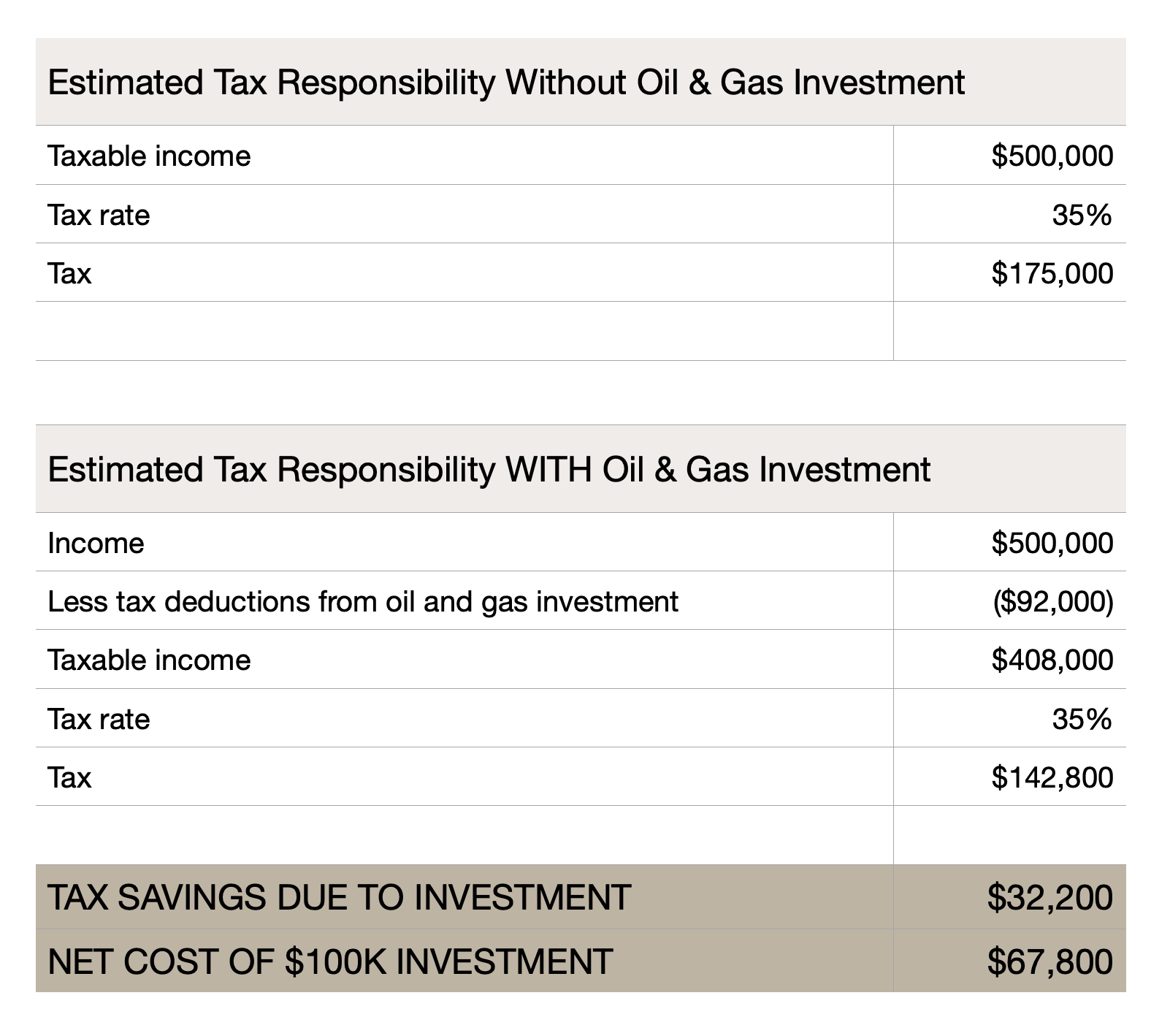

For illustrative purposes, here is an example of how these tax savings may look for someone:

Meet Strom Trooper:

Mr. Trooper makes $500,000 per year

He’s in the 35% tax bracket

He invests $100,000 in an oil and gas deal

Mr. Trooper’s Oil & Gas Tax Deductions in Year 1

80% of his investment are “Intangible Drilling Costs” = $80,000

15% of his investment are “Tangible Drilling Costs”, and 80% of this is tax-deductible = $12,000

So 92% of his investment is tax deductible = $92,000

The above example is for illustrative purposes only. Please consult with your tax professional regarding your individual situation prior to investing.

As you can see in the above example, an investor’s ability to take advantage of tax deductions through direct investment in oil and gas has the potential to significantly and positively impact your basis and therefore, your returns. You should, of course, review this and any other tax-related matters with your tax professional,

Strong Historical Performance and Future Outlook

Oil and gas investments have demonstrated a track record of delivering strong returns. As global energy demand continues to rise, particularly in emerging economies, the demand for oil and gas remains strong. This sustained demand, coupled with limited supply and geopolitical factors, has contributed to significant price appreciation over time. Although we’re currently experiencing a dip in the prices of crude oil - as of the writing of this blog, crude oil is priced at $69 per barrel - the International Energy Agency, in their May 2023 Oil Market Report, anticipates that demand is expected to eclipse supply by almost 2 million barrels per day. They also forecast that oil demand will rise by 2.2 million barrels per day to an average of 102 million barrels per day.

Potential for High Returns

Investing in oil and gas projects, such as exploration and production ventures, can provide the potential for high returns. Successful projects can yield substantial profits, especially during periods of high oil prices. With careful research and due diligence, particularly regarding the operator, investors can identify promising opportunities that offer attractive risk-reward ratios.

Income Generation

One of the appealing aspects of investing in oil and gas is the potential for regular cash flow. Depending on the method in which how one invests in oil and gas, , there may be opportunities to earn dividends or distribution payments. This income can provide a stable and reliable stream of cash flow.

Portfolio Diversification

Diversification is a fundamental principle of investing, and oil and gas investments offer an opportunity to diversify your portfolio. The energy sector tends to have a low correlation with traditional assets like stocks and bonds, meaning that it can perform differently under various market conditions. By including oil and gas investments, you can potentially reduce the overall risk and volatility of your portfolio.

Inflation Hedge

As we’ve seen very recently, Inflation can erode the value of the dollars or currency you hold, sometimes rather quickly. Oil and gas investments have historically acted as an inflation hedge - as prices for energy resources rise, the value of energy-related assets may increase as well. By investing in oil and gas, you can potentially protect your portfolio against the negative effects of inflation.

Technological Advancements and Efficiency

The oil and gas industry continues to evolve, embracing technological advancements and operational efficiencies. These innovations have enhanced exploration and production techniques, resulting in cost savings and improved profitability for companies, oftentimes allowing them to revisit and hit pay dirt on land that was previously explored. Investors can benefit from these advancements, as efficient operations often translate into increased profitability and shareholder value.

What are the risks associated with oil & gas investments?

As with any investment, there are risks to be aware of. Understanding them will help you make more informed decisions about if, how and when you’ll invest in oil and gas.

Market Volatility

Oil and gas prices are highly volatile and can fluctuate significantly due to various factors, including global supply and demand dynamics, geopolitical tensions, economic conditions, and regulatory changes. Sudden drops in prices can impact the profitability of oil and gas companies and therefore, negatively affect investors’ returns.

Geopolitical Risks

The global industry is influenced by geopolitical events, such as conflicts, sanctions, trade disputes, and changes in government policies. These factors can disrupt supply chains, create uncertainties, and impact the profitability of companies operating in the sector.

Regulatory Risks

Because they operate in a highly regulated environment, oil and gas companies must comply with compliance requirements related to safety, environmental protection, and licensing. Violations of regulations or legal disputes can lead to significant financial liabilities and operational disruptions.

Exploration and Production Risks

Exploratory drilling and production activities carry inherent risks. There is no guarantee that drilling efforts will be successful, and even if oil or gas is discovered, the reserves might not be as substantial as anticipated. Unforeseen technical challenges, operational issues, equipment failure, injury to the operators, or environmental concerns can also impact project viability and profitability.

Environmental and Social Considerations

Oil and gas faces increasing scrutiny regarding its environmental impact and contribution to climate change. Regulatory changes aimed at reducing carbon emissions and promoting renewable energy sources could impact the long-term demand for fossil fuels. Additionally, concerns about social and ethical responsibilities can influence public perception and affect the reputation and profitability of oil and gas companies.

Technological Disruptions

The advancement of alternative energy sources, such as renewable energy and electric vehicles, could impact the long-term demand for oil and gas. Rapid technological advancements in extraction techniques, such as hydraulic fracturing ("fracking") or deepwater drilling, could also alter market dynamics and affect the profitability of existing projects.

Investing in alternative investments like oil and gas provides you with an opportunity to diversify your portfolio and generate cash flow while potentially realizing significant tax advantages, but as with any investment, there are risks to consider.

Is this an asset class you would be interested in investing in?

If so, reach out to let me know, so I can tell you about what I’m working on in this space.